- products

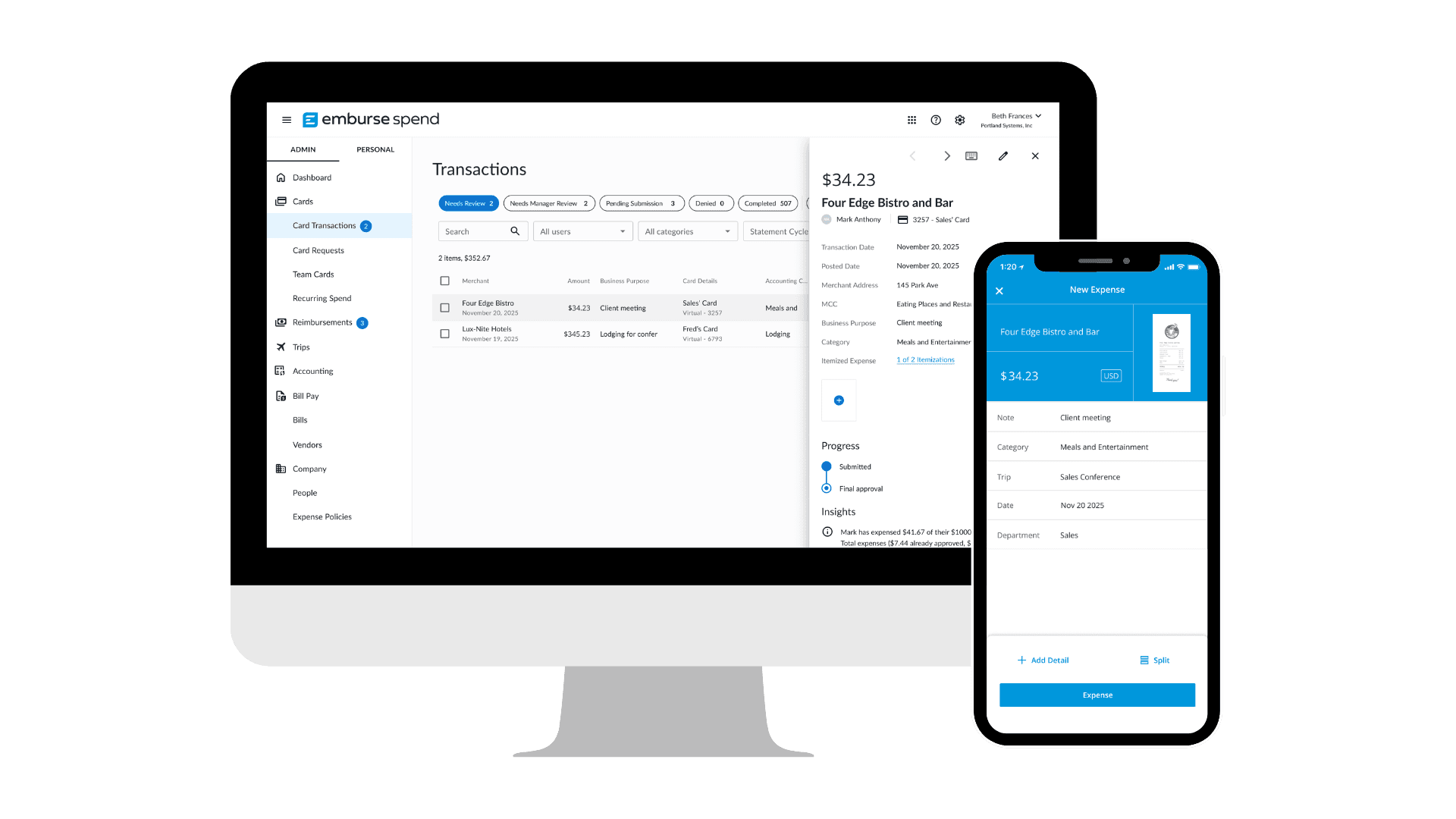

Emburse Spend

Emburse Spend

Close your books 5x faster

Emburse Spend is the modern, all-in-one platform that helps SMBs streamline expense management while keeping their existing credit card program.

Emburse Spend captures a continuous flow of expense data to speed up submission, approval, and reimbursement

- Employees submit their receipt and expense details at the point of sale eliminating the need to compile month-end expense reports

- Expenses are analyzed individually for policy compliance and either auto-approved or sent to the right approver

- Real-time approvals throughout the month remove bottlenecks and speed up reimbursements

Manage your company’s spend all in one place

Receipt capture

Submit receipts via mobile app or forward from your email.

Expense tracking

Save time and reduce errors by automating expense categorization and coding.

Credit card reconciliation

Match uploaded receipts to transactions automatically.

Virtual card management

Create unique virtual cards to control spend and pay invoices.

Accounting integration

Sync expense data with Quickbooks, Netsuite, Sage Inacct, and more.

Expense policies

Automatically flag or block out-of-policy expenses before submission.

Reporting

Analyze spend by project, client, cost center, or any other data in real time.

Reimbursements

Reimburse employees directly to their bank account from the platform.

Why small and medium businesses choose Emburse Spend

Save time with the modern approach to expense reporting

You're a small but mighty team with limited time for month-end expense reports and card statements. With Emburse Spend, employees submit receipts and expenses instantly, giving you:

- Real-time visibility into corporate spending

- Flexibility to review expenses throughout the month

- Ability to reimburse employees faster

Keep your existing corporate card program

Being forced to abandon your existing credit card program can disrupt your workflow. With Emburse Spend, you don’t have to. We believe in flexibility and let you integrate with your current program or choose ours if it’s the right fit for you.

Designed for SMBs to self-implement

You can get up and running on Emburse Spend in as little as 1 week. We’ve designed it to be simple to set up, so you don’t need a team of consultants. Here’s how:

- A built-in configuration wizard guides you step by step

- Weekly webinars with product experts to answer your questions

- Need extra help? Guided implementation support is available

“Emburse Spend helps me save time by spreading out the duties of approving and managing expenses over the month instead of all at once.

Matt Horn

Director of Finance at YayPay

“From an accounting standpoint Emburse Spend has given us valuable month-end closing time back. Coding our credit card statements has gone from 4-6 hours a month to 1 hour.

Micayla F

at G2 Review

“With Emburse Spend, we’ve gained more visibility into our operating expenses and increased control of our spend with a platform that can easily scale with us as we grow.

Morgan McLintic

CEO at Firebrand

Ready to get started?

modern, all-in-one platform that helps SMBs streamline expense management while keeping their existing credit card program.

Emburse Spend FAQs

Expense management software streamlines business finances by automating the process of tracking, submitting, approving, and reimbursing employee expenses. It ensures compliance with company policies, reduces fraud risks, and improves data accuracy.

Key features include:

- Automated Policy Enforcement: Flags rule violations and ensures all expenses align with company policies.

- Integrations: Connects directly with financial institutions and accounting integrations, reducing manual work and human error.

- Actionable Insights: Provides detailed reports and real-time data to support informed decision-making.

Using expense management software transforms finance teams into strategic resources. By automating manual tasks like report creation and data analysis, teams save time and reduce costs. For example the Aberdeen Group estimates the average cost of processing a single expense report is $20.65, but automation significantly lowers this expense while simplifying workflows for employees.

With user-friendly tools like Emburse Spend, employees can quickly log expenses, minimizing disruptions and increasing efficiency across your business.

Emburse Spend is best for startups and small to medium-sized businesses in the USA. It’s particularly valuable for companies where employees frequently make purchases using corporate cards or out-of-pocket, such as for gas, supplies, or other daily expenses. It’s also a great fit for organizations managing recurring expenses like subscriptions or marketing budgets.

Emburse Spend uses transaction-based submission instead of traditional batch submission, providing your team with the ability to to:

- Submit expenses immediately after a purchase

- Apply detailed, expense-level controls to align with company policies and streamline automation

- Customize how expenses are viewed and reported on

This approach is especially beneficial for companies with employees requiring reimbursements. With transaction-based submission, reimbursements can be initiated as soon as an individual expense is approved, allowing employees to get reimbursed quickly. In contrast, batch reporting systems delay reimbursements until all expenses in a batch are approved, often leading to longer wait times for employees.

Emburse Spend integrates with leading accounting systems, including QuickBooks, Xero, NetSuite, and Sage Intacct. This ensures seamless data flow into your existing ecosystem, aligning with your chart of accounts and mapping custom fields such as departments or customers.

Beyond simple data syncing, Emburse Spend automates key bookkeeping tasks. For example, it automatically matches and reconciles expenses with bank debits, saving time and minimizing errors.

Emburse Spend also offers flexibility with both cash and accrual syncing methods. This capability, enabled by Emburse Spend's transaction-based approach, allows expenses to be indexed and synced individually in real time.

You’ll always have full access to your data. Expense data can be easily downloaded as a .csv or PDF file, ensuring transparency and flexibility without restrictions.

By automating bookkeeping and offering robust integrations, Emburse Spend streamlines financial management while giving you greater control over your data.

Emburse Spend provides a centralized view of all issued corporate cards, allowing you to track transactions before the end of the month. This visibility helps you distinguish between reimbursable and non-reimbursable expenses, streamline employee payments, and ensure accurate reporting. With this level of oversight, you can take full control of your corporate card program while reducing the time spent on monthly reconciliations.

Emburse Spend starts at $8 per user per month with a monthly plan. For more information, visit our pricing page.

The best way to experience Emburse Spend is by joining a live weekly demo with our product specialist. You'll see the platform in action and have the opportunity to ask any questions.