44% of finance leaders said they will increase spending visibility and analysis to improve their organization’s financial wellness.

According to a recent Emburse study

Before starting to evaluate an expense management solution

When considering implementing expense management automation within your organization, the initial step is carefully evaluating various software solutions. This critical process begins by aligning internal priorities to ensure that the chosen expense management software meets the specific needs and goals of the business. To do this effectively, it is crucial to understand your current processes and each approval workflow thoroughly. By clearly defining your expense management process, you can identify manual expense areas that can be optimized and streamlined through automation. This method allows for a more efficient comparison of expense automation choices and simplifies the process of eliminating vendors that do not meet your specific business expense needs.

1. Include all stakeholders

The first step in your process to automate expense management is to initiate the evaluation by conducting stakeholder interviews to align all decision-makers and set precise expectations. Establishing clear expectations ahead of time sets the foundation for a smoother, automated expense management evaluation process. For instance, identifying critical expense reporting requirements and strategic objectives is crucial for optimizing cost savings and improving operational expense automation efficiency. Involving stakeholders from the beginning can reduce decision-making challenges and enable seamless implementation.

2. Establish automated expense management requirements

Once stakeholders have met and shared their expectations for an expense management solution, establish a list of non-negotiables. This ensures that the chosen expense management system aligns with your organization's regulatory requirements and upholds internal policy compliance.

In your list of non-negotiables, state the accounting software you use, outline the rules that make up your expense policy, and define your approval workflow.

- Management of corporate card programs for easy expense tracking

- Bill an expense back to a client promptly and accurately

- Monitor spending patterns across various departments and projects to control and manage your budget effectively

- Automate employee expense monitoring for efficient and accurate travel and expense reimbursement

- Utilize real-time dashboards for valuable expense data insights

3. Outline your expense management process

Outline how you would like to improve your current expense reporting process. Focusing on questions such as:

- Does your finance team need help enforcing your expense policy?

- Are employees holding onto expense receipts for months on end?

- Do employees complain that the expense reimbursement process takes too long?

Identifying these critical concerns provides concrete objectives to communicate effectively with potential expense management system providers.

4. Explore your automated expense management system choices: Real-time versus Batch reporting

As you implement expense management automation within your organization, it is time to conduct comprehensive research. This phase involves exploring the various expense management solutions available in the market, each offering distinct advantages tailored to different operational needs.

An automated expense management system can broadly be categorized into two main types: batch reporting and real-time expense reporting. Your choice between these systems will significantly impact the features and functionalities at your disposal, influencing how expenses are submitted, reviewed, and approved within your organization.

Batch reporting solution

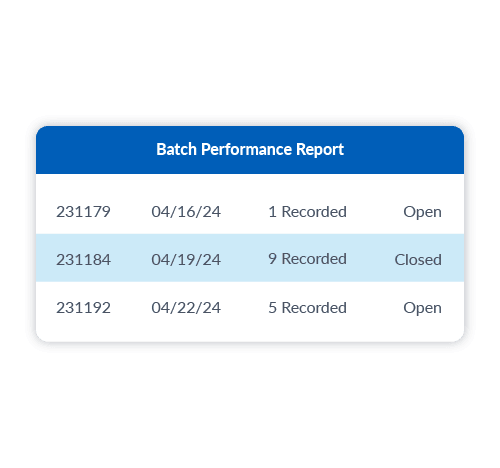

Batch reporting typically involves a manual process where expenses are collected over time, grouped into an expense report, and submitted for reimbursement. Batch reporting systems are known for their efficiency in handling large volumes of expense data systematically and synchronized. They enable users to compile and submit expense reports periodically, streamlining the process and ensuring that all expenses are captured and accounted for efficiently.

Real-time reporting solution

In contrast, real-time expense reporting systems offer a more dynamic and immediate approach to expense report automation. These systems allow for an expense request to be reported and approved in real-time, providing greater visibility and control over expenditure as it occurs. This can lead to expedited reimbursement processes and enhanced decision-making driven by real-time financial information. A real-time expense reporting solution indexes individual expenses, reducing the need for a batched expense report.

Note: The term "real-time" is commonly used but can be misleading as it is often limited to specific functions like receipt capture. A real-time solution treats expenses as individual transactions, logging each separately, similar to how a search engine operates.

Pros: You can create customized workflows, views, and reports tailored to your needs and set granular, expense-level controls for policy compliance and expense automation efficiency.

Con: Embracing a learning curve associated with adopting a new automated expense reporting system.

Selecting the right expense management software

When selecting the right expense management software, a critical step is thoroughly evaluating your finance team's needs and operational processes. Distinguishing between batch reporting and real-time expense reporting is necessary for making an informed choice that can enhance the efficiency of your automated expense management software. By comprehensively analyzing each software type's features, capabilities, and operational implications, you can ensure that the selected expense management solution effectively meets your organization's requirements for expense tracking, generating expense reports, and managing each approval process. Selecting a system that seamlessly aligns with your company's goals is critical to automating expense management.

For more information on the benefits of expense management automation and explore how organizations like yours are moving away from manual expense reporting, refer to the additional resources provided below:

ROI Calculator

Calculate the return on investment you could experience with Emburse Spend based on industry data from GBTA and the IOCP.

GF Sports & Entertainment Case Study

Learn about how GF Sports & Entertainment implemented Emburse Spend in one week, and achieved ROI within two months.