Why Every Organization Needs Expense Management Automation

Why you need expense management automation

In today's economy, characterized by high interest rates costs and tight budgets, effective expense management practices are not just beneficial – they are critical. In traditional expense management practices, handling scattered expense data across different systems makes controlling costs, managing cash flow, and enforcing policy compliance complex and time-consuming.

Gain control over the expense reporting process

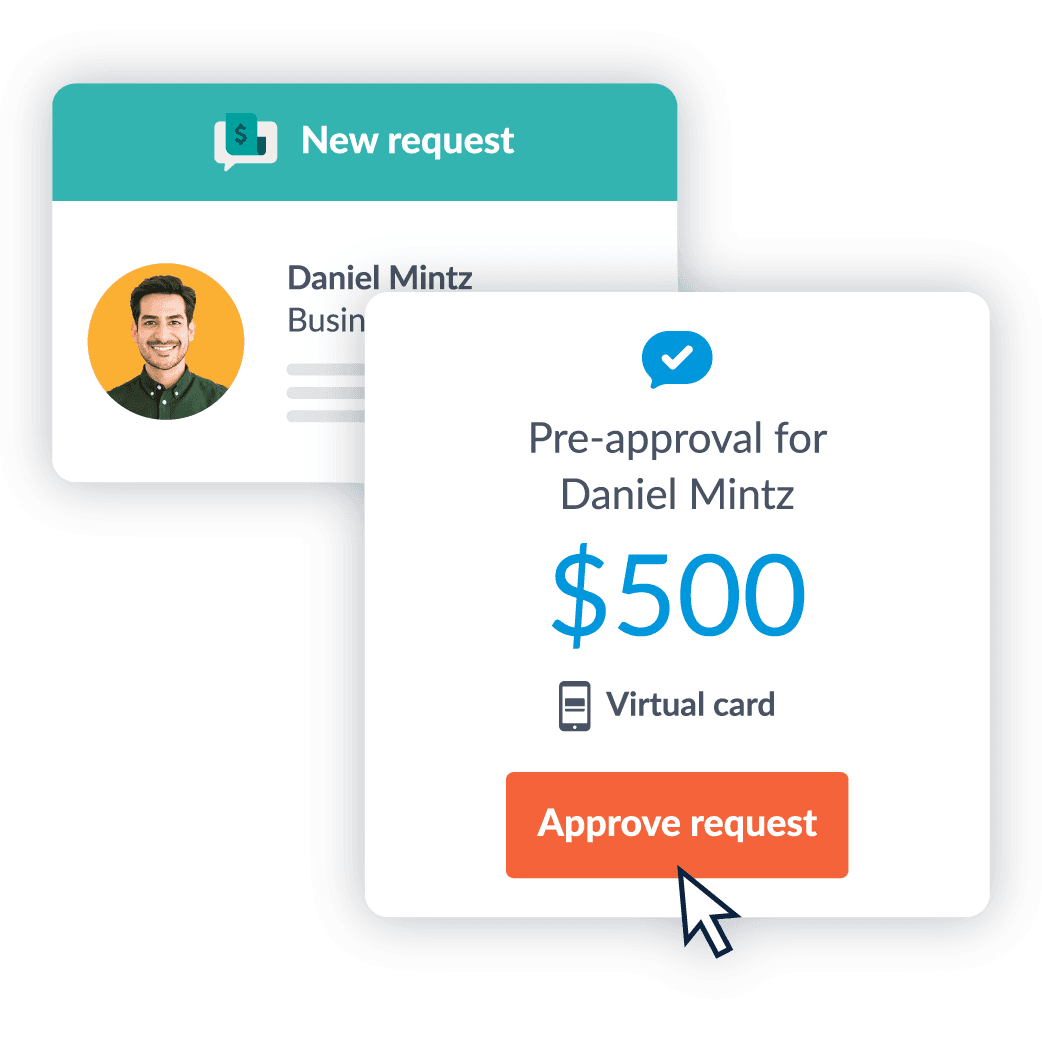

Maintaining employee expense policy compliance and reducing the risk of expense fraud are crucial priorities and challenges for employees tasked with reviewing and approving expenses. Research has found that nearly 20% of expense reports contain errors, with fraudulent expenses often containing missing or incorrect information or outside of policy 1.

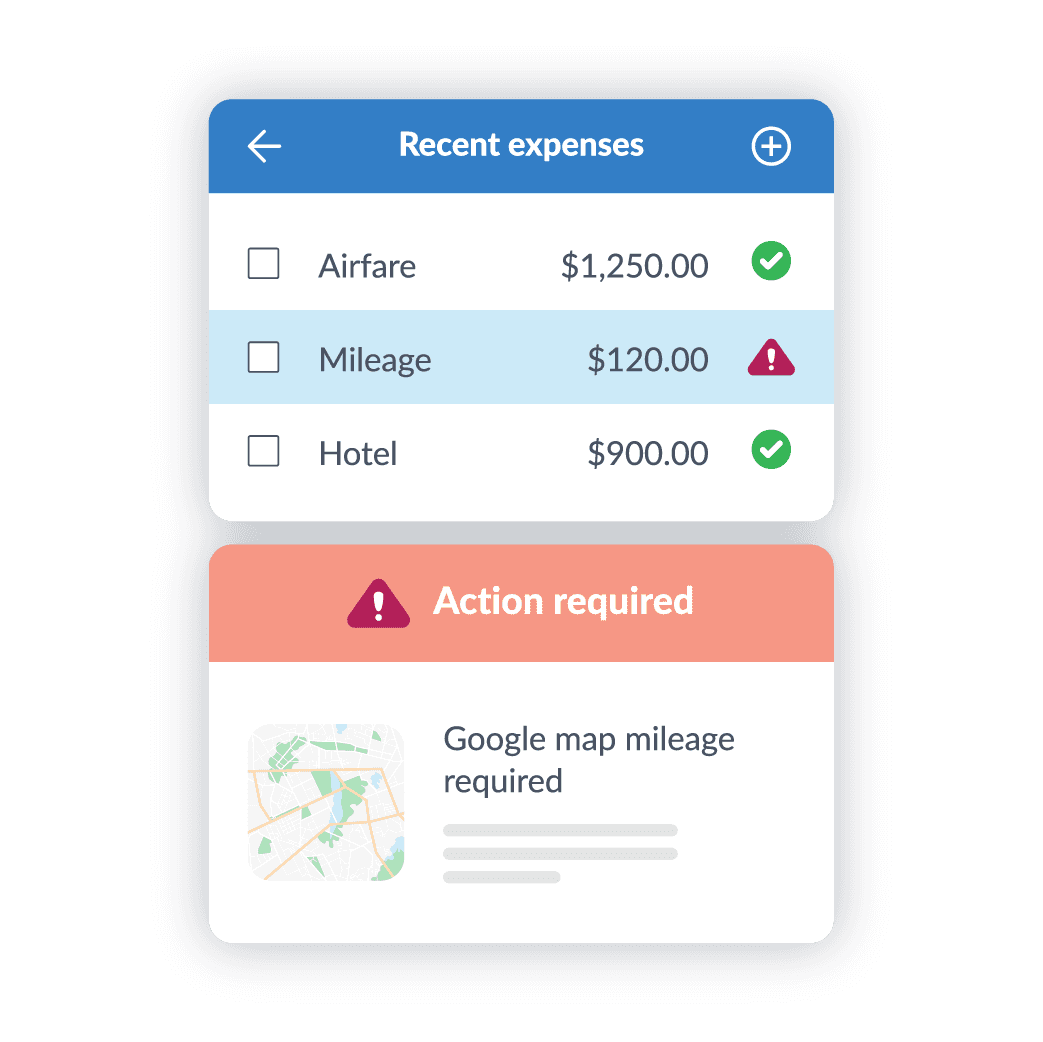

Automated expense management ensures data accuracy and compliance with each expense submission, by automatically flagging any expense requests that violate the policy enforced in the system. Expense automation decreases the manual expense management workload by identifying duplicates, errors, and violations before approval, leading to a fully automated approval workflow and reimbursement process.

1 Global Business Travel Association

Companies saw a 64% reduction in errors and 40% improvement in policy compliance when using an expense management solution

The Aberdeen Group

Improve cash flow management and unlock spend insight

The best expense management solutions empower any finance team to become a leader of a data-driven business, creating more space for analysis and data-backed decision-making. Through expense automation, a finance team can utilize expense tracking, view real-time expense data, and gain insights employee spending at a granular level across the business. Instead of hours spent pulling outdated reports and sifting through spreadsheets full of data when using a manual expense management process, your finance team can easily access insights from spending patterns that help drive your business forward.

Having continuous visibility into spending represents one of the big breakthroughs with this software category. In the past, many finance processes had to be completed in batch mode.... Now you can keep tabs on your spending continuously, so there are no surprises at the end of the month.

Robert Kugel

Senior Vice President and Research Director at Ventana Research

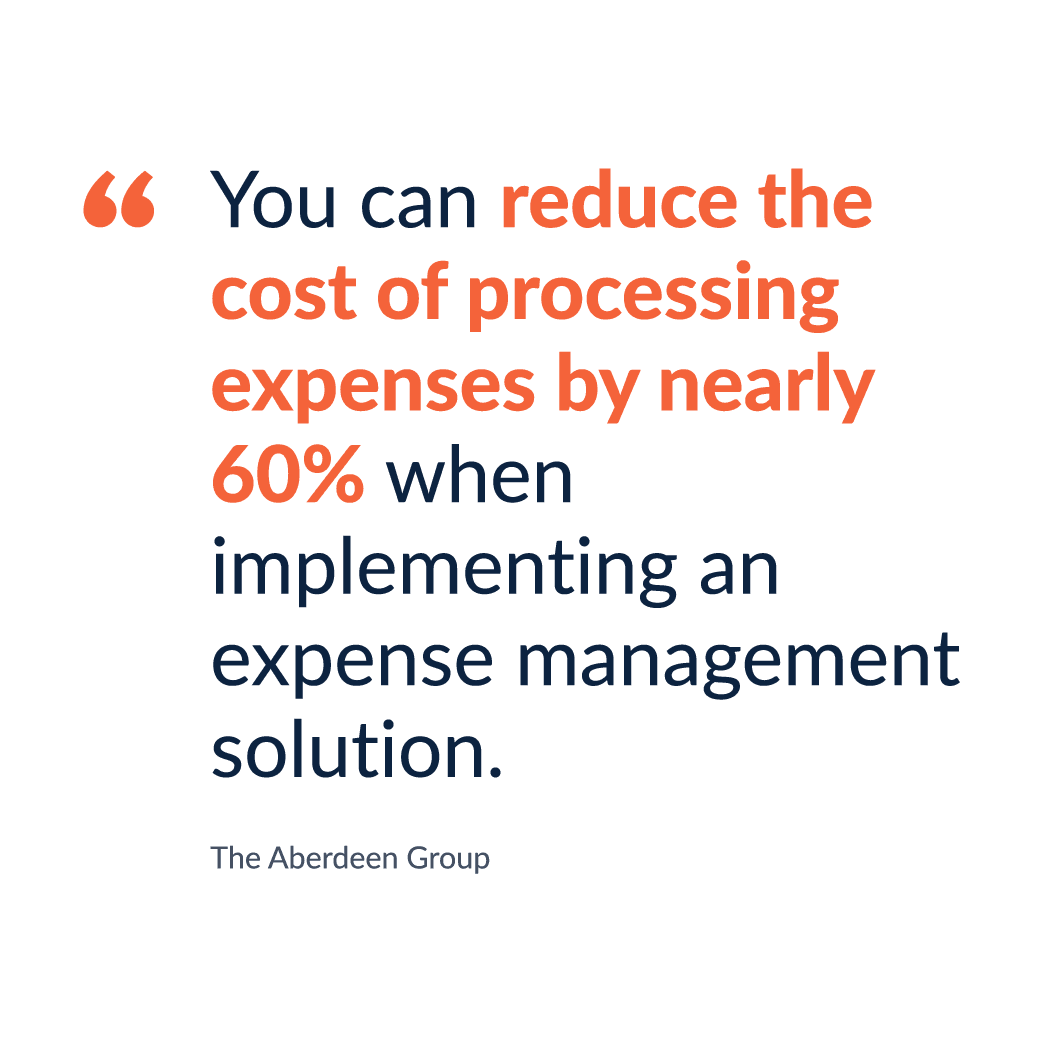

Boost efficiency for your employees while increasing cost savings

According to the Global Business Travel Association, the average cost of processing a single expense report is $58, factoring in the time it takes for finance to review, approve, file, and issue expense reimbursement.

An automated expense management system improves organization efficiency by proactively reducing errors and expense policy violations before submitting an expense report, saving finance time when reviewing an expense claim. The benefits of automating expense management, such as time savings and employee experience, go beyond the finance department. Simplifying and streamlining the expense management process enhances employee spending across the organization when submitting expense reports.

The ROI of expense management automation:

$58

Average business cost to process a single expense report without expense report software

$49

Average business cost to process a single expense report with expense report software

1.5

Average expense reports submitted per employee per month

To determine how much you could save each month, you need to know the average cost of processing expense reports. If you don't have this information, you can use GBTA's template. Simply multiply the industry average cost for processing a single expense report by the number of expense reports you process each month. If you are unsure about the number of expense reports, you can use the industry average cost per employee and multiply it by the number of employees in your organization.

Next, you will want to figure out what it would cost with expense management software in place to process your monthly expenses. You can estimate this cost based on how much time you believe the software will save you compared to your current process. Alternatively, you can use data from GBTA to make your estimation.

Subtract the new costs from the old costs to see your monthly savings.

Finally, you can calculate how much ROI of automated expense management solution would be by subtracting the new monthly processing costs from your savings and dividing the total by your new monthly cost. In other words, will the cost savings move the needle?

Here is what the ROI calculation using GBTA’s data would look like for a company with 150 employees:

[$58 x (150 x 1.5)] = Current monthly processing costs of $13,050

[$29 x (150 x 1.5)] = New monthly processing costs of $6,525

[$13,050] – [$6,525] = $6,525 in monthly savings

or an ROI of ($13,050 – $6,525) / $6,525 = 50%

This translates to saving more than $6,000 a month on processing costs.

For more information on how your organization can benefit from expense automation, check out the resources below:

ROI Calculator

Calculate the return on investment you could experience with managing expenses with Emburse based on industry data from GBTA and the IOCP.

2023 Spend Management Trends Report

Emburse surveyed more than 500 finance professionals for insight into how organizations are applying spend management and automated expense reporting techniques.