Emburse Business Travel Snapshot: November 2024

Examine the key trends that shaped 2024, analyze air and hotel pricing data, and get strategic guidance to help you navigate the negotiation season ahead.

2025: The Year Business Travel Bounces Back

Nearly four years ago, the Global Business Travel Association (GBTA) predicted that business travel would recover by 2025, with spending reaching approximately £1.03 trillion by 2024.

Not surprisingly then, new data from July 2024 suggests this prediction will come to pass, with global spending on business travel anticipated to hit nearly £1.08 trillion by the end of the year, surpassing 2019’s figure of £1.05 trillion.

In Europe, the business travel sector is seeing a steady resurgence. According to the GBTA, expectations for business travel spending remain positive across regions, with European travel buyers anticipating a 37% increase in trip volume this year.

That said, a lot has changed in the last five years. Remote and hybrid work has impacted business travel significantly. The blending of business and leisure travel (or “bleisure”, as it’s known) is becoming more commonplace and travellers are more conscious of their well-being and environmental impact than ever before. AI continues to demonstrate its ability to deliver real business value by optimising the rate and fare-setting process at airlines and across hotel chains.

2025 marks a new era of business travel. As we approach the end of the year and gear up for a challenging negotiation season with suppliers, buyers must reset their expectations on pricing, using 2024 as a baseline where price growth has normalised.

Travel costs are set to rise next year, with hotel rates increasing 4.5% and negotiated airfares up 5.4% in 2024. However, cost savings can still be realised by those who are strategic in their efforts and know where to look.

In this November 2024 edition of our Business Travel Snapshot, we'll analyse the key trends that have shaped 2024, providing an expert perspective on comprehensive year-over-year data and what it means for your 2025 travel budget.

I hope you find these recommendations valuable as you navigate the evolving business travel landscape and future-proof your T&E program for 2025 and beyond.

Steve Reynolds

Chief Strategy Officer

Emburse

Methodology

The data outlined in this report is sourced from Emburse Travel Analytics’ (formerly TRIPBAM Analytics) and includes global hotel and air data covering North America, EMEA, and APAC. The analysis is based on data pulled on Nov 8, 2024 from Emburse’s system and is based on a 12-month average unless otherwise indicated in the text or charts that follow. The booking data is limited strictly to corporate bookings made by Emburse customers and does not include leisure or group bookings.

Looking Ahead to 2025: Top 4 Trends

Corporate airfares are likely to increase in 2025

Based on historical Emburse travel and expense data, fares increased from Nov 2023 to 2024 by 7.6% and will likely continue to increase into Q4 2024 and 2025.

The primary drivers of this trend are a lack of supply due to airline manufacturer production issues, the continued drop in leisure travel post-pandemic, and an increase in corporate travel by larger Fortune 1000 corporations. Airlines will likely attempt to increase fares through 2025 and charge higher fares for business travel within major corporate markets to offset lost revenue from the leisure travel sector.

On the bright side, with American Airlines changing its position on corporate discounting, they will be more aggressive in enticing corporate customers to come back. Competitors will counter with lower discounts to maintain market share gained in 2024. If possible, consider negotiating your airline contracts this year rather than waiting until they reach term.

Hotel rates are also expected to rise in 2025

Major corporate markets in the US and Europe will likely see the largest increases in hotel rates (approximately 5% to 7%), while secondary markets will see a much lower increase, with China seeing a reduction.

Corporate rates will likely flatten in the second half of 2025 due to lower inflation and greater capacity entering the market as hotels open a record number of new properties. Emburse’s stance is neutral on whether to adopt fixed or dynamic rates, as rates will likely increase in the first half before declining in the second.

AI’s influence will continue to grow

While not fully realised yet, AI will have a big impact on corporate travel over the next several years.

Revenue managers at hotels and airlines will rely heavily on AI to predict rate and fare changes. This automation could result in much greater and more frequent fare and rate fluctuations. Costs will be reduced as call centers and chatbots are managed by AI systems.

Corporate buyers to mine corporate travel and expense data to best predict volumes by market, per diems by location, acceptable rates and fares, and more.

At Emburse, we’re pushing the boundaries of what’s possible with AI in travel and expense management. We’re currently focused on the latest commercial and open-source AI models to drive our systems toward near-perfect accuracy. A standout example of this is our Optical Character Recognition (OCR) transcription capabilities, which will seamlessly process any type of document—whether it’s itemized receipts or invoices—from over 99% of the countries and currencies we operate in. By constantly refining these models, we are creating a future where errors are virtually eliminated and the need to manually enter data will be minimal, if any.

Corporate travel policies will become more friendly and flexible

The days of the draconian corporate travel policy with mandated flights and hotels based on the best fare or rate seem to be over—for now.

Corporate buyers are giving travellers more latitude in purchasing to keep traveller satisfaction high. Based on our experience, allowing direct bookings with suppliers can boost travel satisfaction scores by up to 25%, while potentially reducing costs by eliminating agency fees and accessing exclusive online rates and fares.

The challenge for buyers is to capture direct bookings for duty of care, auto-populating expense reports, and analytics. Fortunately, new technology is emerging to make this easy to address, with business travellers benefiting in these areas.

Market Review: Hotel

The hotel industry is stabilising as the post-pandemic surge in demand transitions from leisure-focused to a more balanced mix of business and group travel.

The leisure segment has seen a notable slowdown for two consecutive quarters (Q1–Q2 2024), primarily due to declining consumer savings and a cooling labour market. The moderation in leisure travel is being offset by strong growth in the business, group, and international segments. The MICE (Meetings, Incentives, Conferences, and Exhibitions) sector has shown particular strength throughout 2024, and continued growth is anticipated. These segments are projected to recover beyond pre-pandemic levels by 2025.

Despite these demand fluctuations, the hotel industry is expected to maintain strong performance. Limited supply growth has helped sustain high occupancy rates and drive rate increases. However, this trend is not uniform across all markets. For example, London is bucking the limited supply trend, with plans to add 11,155 rooms by 2026.

Looking ahead to 2025, annualised growth for the hotel market is expected to settle back to more modest levels below 4%. This forecast suggests a stabilisation of the market as it transitions from an exceptional recovery period to one more in line with traditional industry growth patterns.

Hotel prices are trending up, but so are discount rates

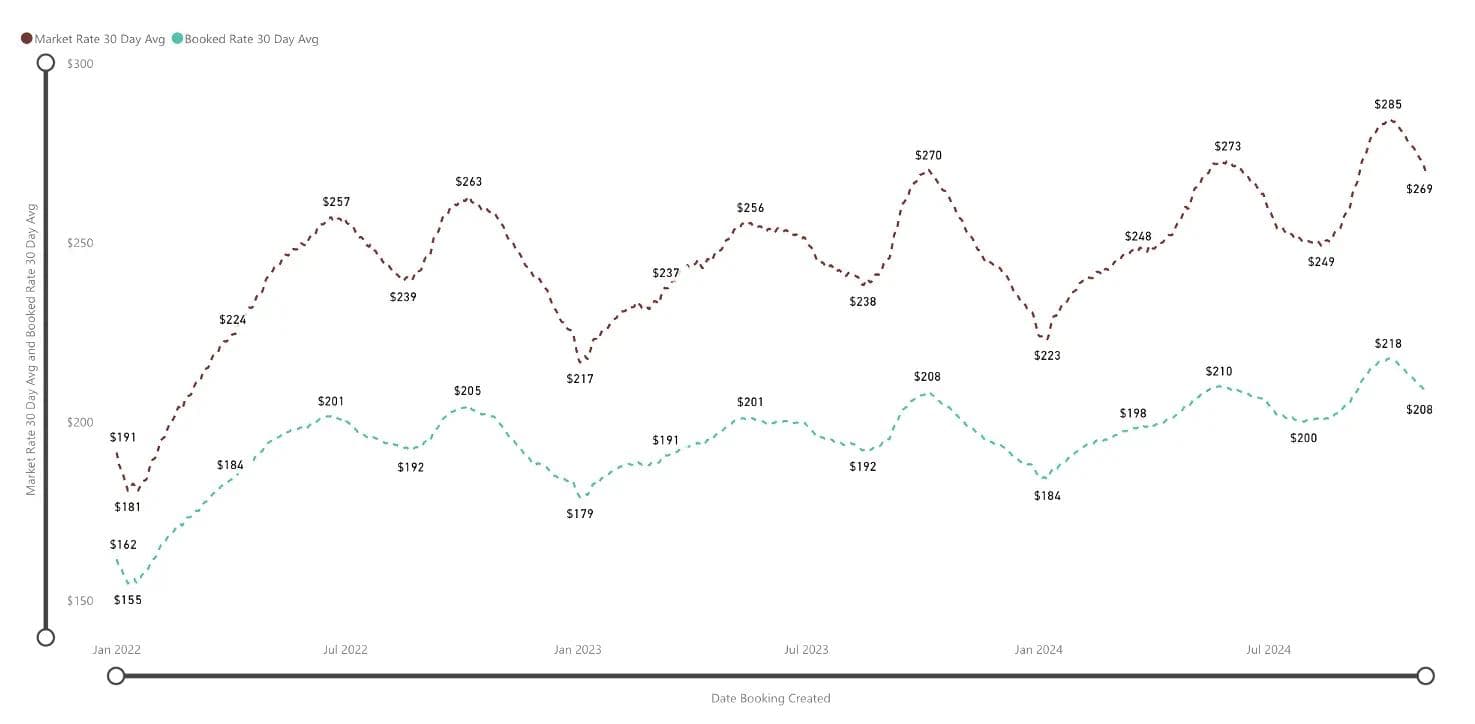

30-day average hotel market rate vs. booked rate (Emburse Travel Analytics)

Our data indicates a moderate hotel price increase over the past year, with the 30-day average market rate rising 5.4% to £197 and the 30-day average booked rate increasing 4.5% to £152.

The good news is that the hotel discount rate has widened to 22.6%, which is significantly higher than the 5% to 10% we saw coming out of the pandemic. We expect the discount rate to widen further, and as such, we recommend targeting a discount of 23% when negotiating hotel rates.

Bookings with offers are trending up, too

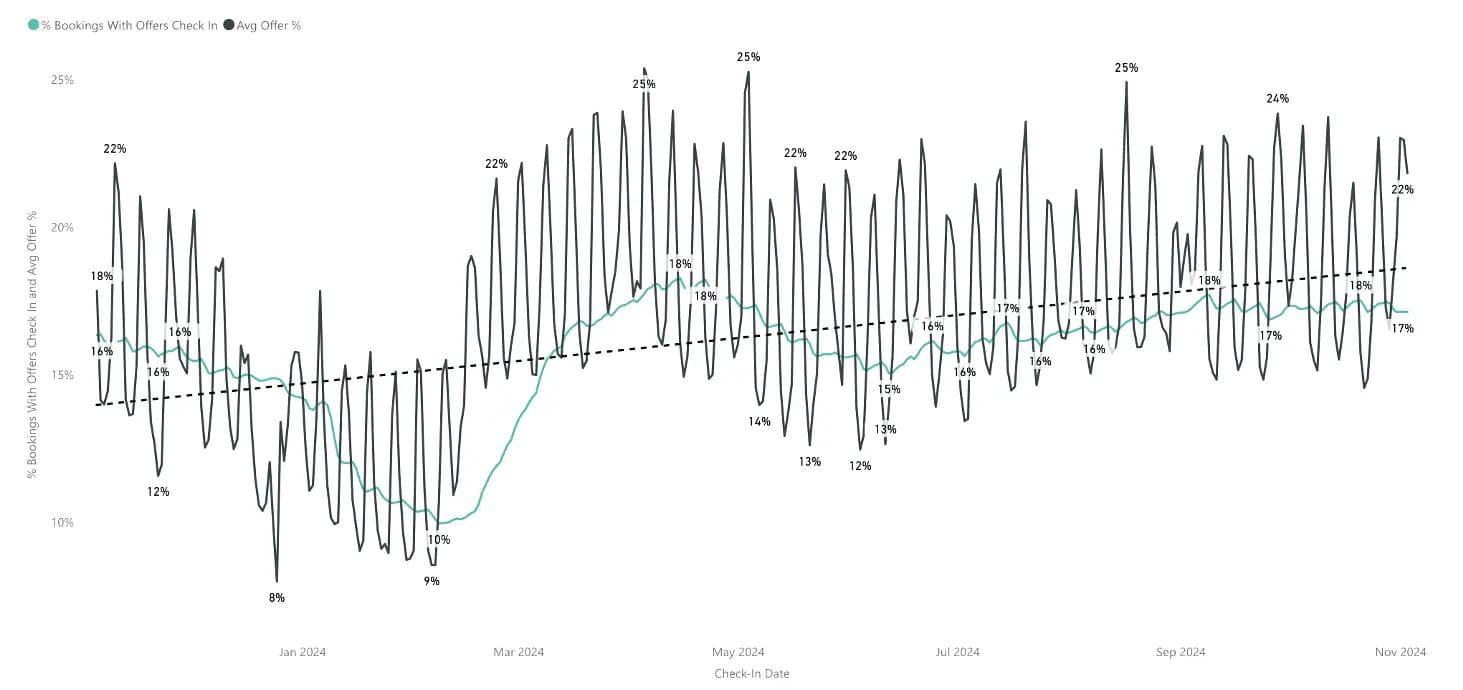

Hotel discount rate and proportion of bookings with offers (Emburse Travel Analytics)

Discounted hotel bookings have steadily increased, with bookings rising 1.3% year-on-year over the past 30 days. Currently, 17% of all reservations are being made at discounted rates, with customers securing an average discount of 22%.

This upward trend in offer-based bookings is projected to strengthen throughout 2025, with anticipated savings increasing by approximately 5% compared to 2024 levels.

Beware hotel rate hotspots

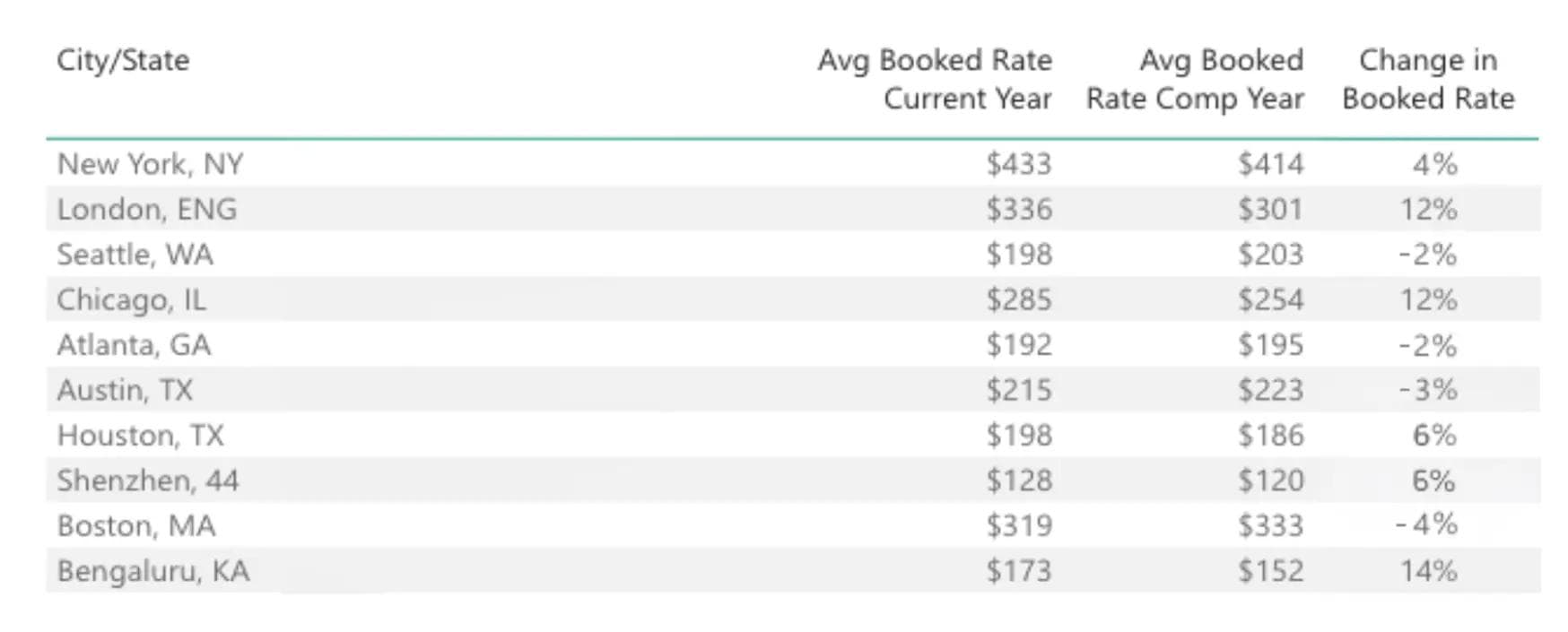

Top 10 cities by volume (Emburse Travel Analytics)

Hotel booking volumes have rebounded to pre-pandemic levels across major cities, showing significant growth from 2022. However, most top destinations are seeing decreased booking rates, with New York, London, and Chicago being notable exceptions, likely due to their increased schedule of major events in 2024.

Among global cities, Chicago (12%), London (12%), and Toronto (14%) stand out with the highest hotel rate increases, while Scottsdale (-11%), Barcelona (-9), and Boston (-4) have recorded the most substantial hotel rate decreases.

In light of these market dynamics, we recommend concentrating rate negotiation efforts, particularly in Scottsdale, Barcelona, and Boston, where the current downward pricing trends create favourable conditions for securing advantageous terms.

Market Review: Air

The global air travel landscape is shifting as we approach 2025. After years of volatility, airfare prices are finally showing signs of stabilisation, with only modest increases anticipated in the year ahead.

Business travel volumes are projected to exceed pre-pandemic levels in 2025, marking a significant milestone for the travel industry. This recovery coincides with an expected cooling in leisure travel demand, potentially creating a more favourable environment for corporate travel negotiations. Yet buyers should still prepare for some challenges in securing advantageous terms, as airlines increasingly focus on optimising their revenue through yield management rather than discounts.

As of August 2024, 25% of British Airways' sales were conducted through its New Distribution Capability (NDC) channel, with expectations for this figure to continue growing. This shift reflects a broader industry trend, as airlines increasingly prioritise direct distribution strategies to offer more tailored fare options and maximise revenue opportunities. For corporate travel buyers, the rise of NDC presents both opportunities and challenges—unlocking access to exclusive fares and enhanced servicing options while requiring a strategic approach to supplier negotiations and technology adoption

On that note, NDC channels are likely to offer the most substantial discounts in 2025 as airlines actively shift away from traditional GDS channels in favour of direct booking options. It’s therefore no wonder that NDC adoption has shown remarkable growth, with ARC-settled NDC transactions rising from 5.6% in April 2022 to 19.3% in April 2024. We expect this momentum to build, as evidenced by Amadeus’s five-fold increase in NDC bookings over the past year and some airlines now processing half of their bookings through NDC channels.

It’s therefore no wonder that NDC adoption has shown remarkable growth, with ARC-settled NDC transactions rising from 5.6% in April 2022 to 19.3% in April 2024. We expect this momentum to build, as evidenced by Amadeus’s five-fold increase in NDC bookings over the past year and some airlines now processing half of their bookings through NDC channels.

Given this shift toward NDC channels for premium content and competitive pricing, we recommend prioritising two key actions: actively monitoring direct booking channels and selecting TMCs that offer comprehensive NDC integration across their sales platforms. This approach will give you access to the best available rates and content while streamlining your travel booking process.

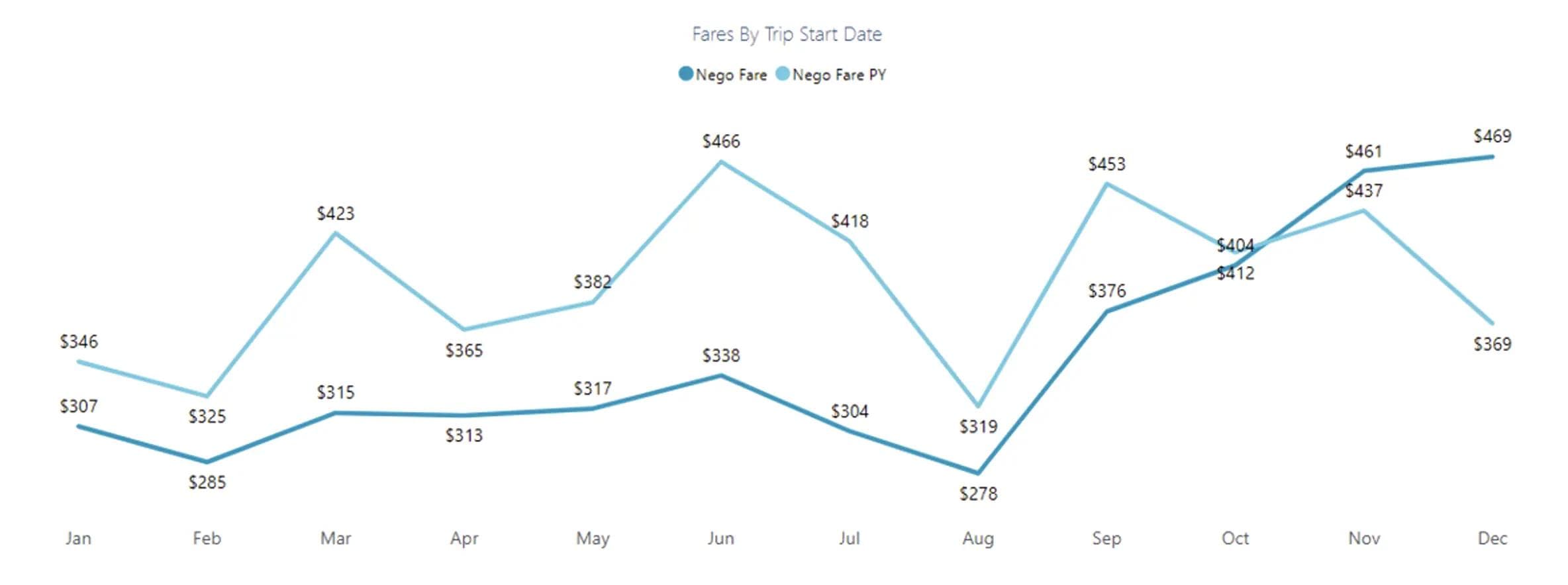

Airfares stabilising but expect a modest increase in 2025

Negotiated fares YTD 2024 vs. 2023 (Emburse Travel Analytics)

Our data from November 2023 to November 2024 shows a measured upward trend in airfares, with market fares rising 7.4% from £373 to £403, while negotiated fares increased 5.4% from £320 to £337.

Notably, the discount gap between market and negotiated fares has widened from 14.3% to 16.3% during this period, offering enhanced savings opportunities through corporate agreements.

We anticipate fare increases to continue in 2025, driven by ongoing airline capacity constraints and rising operational costs.

European Airlines' NDC Performance Shows Mixed Results

As UK and Europe-based airlines accelerate their NDC adoption, buyers are seeing varying levels of savings and access to richer fare content. British Airways, which now processes 25% of its sales through NDC, has been a key player in this shift while Lufthansa leads in IATA’s Airline Retailing Maturity program with 49 NDC capabilities.

Despite these advancements, savings through NDC remain inconsistent across carriers. While some negotiated rates have led to significant discounts on international routes, buyers should be aware that fare structures and refundability policies may vary. As NDC adoption grows, corporate travel programs should closely monitor how these changes impact savings potential and policy compliance.

Advice for Buyers

1. Focus on the rate (not amenities)

Hotels are increasingly offering guests the option to forgo certain amenities or services in exchange for lower rates. This approach allows guests to decline benefits like parking, breakfast, or premium toiletries to reduce their overall bill. We recommend leveraging this cost-saving opportunity in your negotiations with hotels. With the current softening in leisure travel demand, aim to secure discounts between 20% to 23% during contract negotiations.

2. Renegotiate airline contracts

British Airways’ increasing focus on NDC adoption signals a significant shift in airline distribution strategies. Corporate buyers may find themselves in a strong position to renegotiate contracts, especially as competing carriers continue expanding their NDC capabilities. Airlines are prioritising direct channels and richer content offerings, which presents an opportunity to reassess agreements and secure better discount structures before these changes take full effect. Now is the time to evaluate your airline contracts and ensure your travel program remains cost-effective.

3. Budget for price increases

Travel costs are projected to rise in 2025, with hotels and airfares showing modest but notable increases. Hotel booked rates are expected to climb 4.5% compared to the previous year, while negotiated airfares will increase by 5.4%. Despite these price escalations, the market still offers opportunities to secure discounts, with widening discount rates providing some potential for cost mitigation. We recommend preparing your travel budgets to accommodate these price increases while actively seeking negotiation opportunities.

4. Focus hotel negotiation efforts on less popular cities

While Chicago, London, and Toronto have seen substantial increases in hotel rates of 12-14%, markets like Scottsdale, Barcelona, and Boston have moved in the opposite direction, with hotel rate decreases of 11%, 9%, and 4%, respectively. This divergence presents an opportunity to minimise travel spending by focusing negotiation efforts on declining markets, where hoteliers may be receptive to more favourable terms and conditions.