- solutions

B2B payments, explained.

B2B Payments

B2B payments, explained.

B2B Payments refer to financial transactions made between two businesses or companies. These payments can include purchases, invoices, and other types of financial exchanges between business entities. Discover expert insights to all of your questions about B2B payments.

B2B payments FAQS

Emburse FAQs

Challenges in B2B payments include complex payment processes, security concerns like fraud, delayed payments, duplicate payments and reconciliation issues. Solutions include implementing automated payment systems, utilizing secure payment gateways, establishing clear payment terms and agreements, and leveraging technologies like electronic invoicing and payment platforms.

The best way to facilitate recurring B2B payments is by setting up automated recurring billing systems. This involves establishing a schedule for recurring payments, securely storing payment information, and automating the payment process to ensure timely and accurate transactions.

Yes, there are various business-to-business payment solutions available. These solutions include electronic payment platforms, online payment gateways, virtual cards, ACH transfers, and other specialized B2B payment systems designed to streamline payment processes between businesses.

B2B payments are typically done through various methods such as bank transfers, wire transfers, checks, ACH payments, corporate credit cards, and electronic payment systems. The specific method depends on the preferences and agreements between the business partners.

Recent trends in B2B payments made via check indicate a shift towards electronic payment methods. However, some businesses still rely on checks due to existing processes, familiarity, and the need for physical documentation. Electronic payment solutions are gaining popularity due to their speed, security, and cost-efficiency.

Checks are still dominant in B2B payments due to factors such as familiarity, traditional business practices, lack of government regulation (ex: EU) and the need for physical signatures and documentation. However, as technology advances and electronic payment solutions become more prevalent, the dominance of checks is gradually decreasing.

Business-to-business (B2B) payment refers to financial transactions between two or more businesses. It involves the exchange of funds for goods, services, or other business-related expenses.

Technologies that support B2B payments include electronic payment systems, online payment gateways, mobile payment apps, virtual cards, blockchain-based payment platforms, and automated clearing house (ACH) transfers. These technologies facilitate secure and efficient B2B transactions.

The benefits of B2B payments include increased efficiency, faster transactions, reduced manual processes, improved cash flow management, enhanced security, better visibility, and streamlined reconciliation. B2B payment solutions can help businesses save time, reduce costs, and strengthen business relationships.

To reduce late B2B payments, businesses can implement strategies such as clear payment terms and policies, offering incentives for early payments, sending timely reminders, automating payment processes, using electronic invoicing and payment systems, and maintaining open communication with customers or partners regarding payment expectations.

Technologies that support B2B cross-border payments include international wire transfers, global payment gateways, foreign exchange platforms, blockchain-based solutions, and international payment processors. These technologies facilitate secure and efficient cross-border transactions, enabling businesses to expand their global operations.

Challenges of B2B credit card processing include higher transaction fees, credit limits, security concerns, potential chargebacks, and the need to comply with Payment Card Industry Data Security Standard (PCI DSS) requirements. Additionally, some businesses or vendors may not accept credit cards for B2B transactions due to the associated costs and risk factors.

Digital bill payment solutions help maximize cash flow by enabling businesses to receive payments faster, automate invoicing and payment processes, reduce manual errors, improve accuracy, and provide real-time visibility into payment status. This streamlines cash flow management and ensures a steady inflow of funds.

A business may have cash flow problems due to various reasons, such as delayed customer payments, excessive inventory, high operating costs, seasonal fluctuations, economic downturns, inefficient accounts receivable management, or over-reliance on credit. These factors can disrupt the balance between cash inflows and outflows, leading to cash flow issues.

The advantages of B2B online invoicing include faster invoice delivery, reduced paperwork and fraud, improved accuracy, simplified payment tracking, real-time updates on payment status, streamlined reconciliation, enhanced customer convenience, and cost savings. B2B online invoicing systems offer businesses greater efficiency and transparency in their invoicing processes.

ACH payments, or Automated Clearing House payments, are electronic transactions that allow funds to be transferred between bank accounts within the United States. ACH payments are commonly used for B2B transactions, direct deposits, bill payments, and other types of electronic fund transfers.

To send an ACH payment, businesses typically need to set up an ACH payment system with their bank or use a third-party payment provider. The process involves obtaining the recipient's bank account details, initiating the payment through the chosen system, and authorizing the transfer. The funds are then electronically transferred between the accounts.

Customer success

What our customers love about us

“Working with Emburse feels like a true partnership where they really listen to our needs and care about our success and happiness, which is something we didn’t have with Concur.

”

Dawn Conway

Senior Business Analyst at BELFOR

“Emburse solutions humanize work by providing products and services that make it easier for people to do their jobs.

”

Craig Lundskog

at Great Basin Industrial

“Any company that is expecting growth needs to automate AP processes. Emburse will save you the cost of hiring additional AP staff and also give you time back for more innovative work to help your company grow.

”

Dan Sangeorge

at ALKU

“We now have happier users, and the streamlining of processes and workflows, combined with the improved spend visibility has delivered huge benefits for the firm worldwide.

”

Neil Ackley

at Latham & Watkins LLP

“Modern solutions like Emburse help support our mission and enable us to deliver educational programs to the world's most vulnerable communities.

”

Shari Freedman

at Room to Read

“Emburse is intuitive to use and easily integrates with our other finance systems and credit cards. The result is a 100% paperless expense reimbursement process.

”

Michael Sullivan

at PX Technology

About Emburse

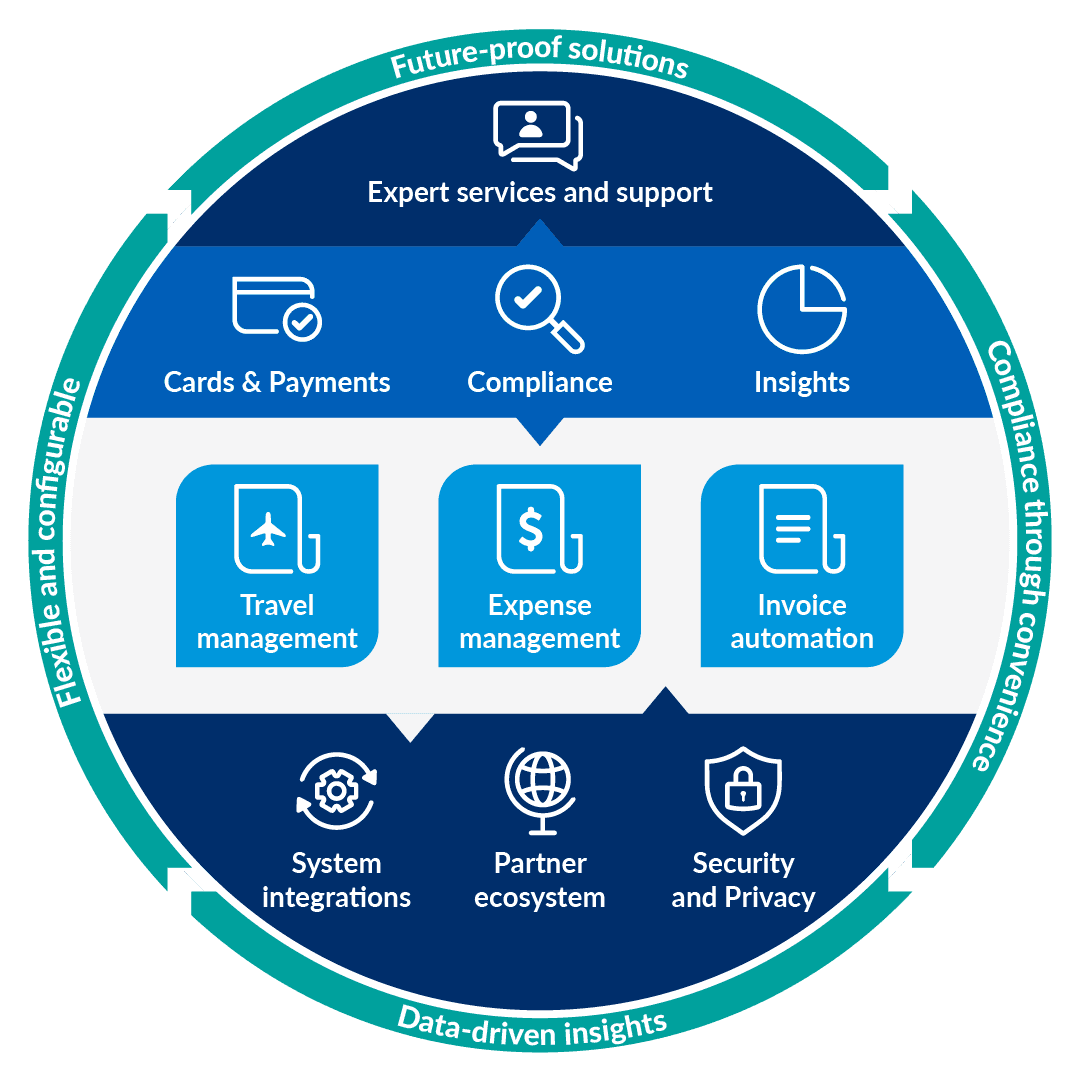

Our growing technology ecosystem

Emburse can help you get the most out of B2B payments.

Emburse is the global leader in helping organizations simplify spend management. Our expense travel and expense management, purchasing, accounts payable, and payments solutions are trusted by over 12 million business professionals, including CFOs, finance teams, and travelers.

Ready to take your B2B payments to the next step?

With Emburse, you can efficiently simplify your B2B payments, reduce administrative tasks, and make informed financial decisions to drive business growth.