Expense Fraud, User Experience, and the Bottom Line

The CFO’s Guide to Surviving Spendageddon

Introduction

If you’re a finance leader who believes your travel and expense (T&E) management system offers exceptional user experiences, you may not realize the impact certain operational processes have on employees’ finances—even driving them to commit expense fraud. Even if tension around T&E policies isn’t an issue in your organization now, be mindful of implementing cost reduction strategies that may trigger it.

This report examines the social, economic, and technological issues contributing to this problem and provides battle-tested recommendations to help finance leaders avoid a Spendageddon in their own business.

Setting the stage for Spendageddon

It’s not just you: finance leaders everywhere are tightening their belts. In the wake of the vibecession (perception of a down economy leading to organizations proactively making budget and job cuts) and in the push for return-to-office (RTO) mandates, the pressure is on to increase profitability and boost margins. If you can’t grow your revenue as quickly or as much as needed to hit your targets, you have to trim your expenses. Right now, many companies are facing the latter objective head-on.

However, this goal increasingly conflicts with employees’ needs, as the reality of stringent cost control measures really becomes apparent in their day-to-day experiences with T&E policies. And most employees’ needs are reasonable—they want it to be easy to buy and pay for what they need to do their jobs; they want to know what their budget is and what they can spend it on; they want to be reimbursed quickly when they use their personal cards. When the cost of living skyrockets, employees don’t want to submit an expense and wait for reimbursement; they want to use corporate cards and insulate their personal finances.

Our survey of more than 1,000 finance leaders shows many employees aren’t getting the flexibility and transparency they need from corporate T&E policies.

The transition to hybrid work has created ambiguity around reimbursable expenses. Employee frustration with archaic T&E policies is mounting, expense fraud continues to increase, and remote work expense fraud lawsuits are making headlines.

Organizations that lack the right tools, processes, or policies to adequately manage employee T&E are nearing a dangerous combustion point. They’re heading straight for a Spendageddon.

Spendageddon occurs when tension peaks between employees’ needs and finance department practices, causing finance leaders to lose control of spending and their ability to protect the bottom line. It’s the result of two forces colliding—finance and employees—because of their conflicting needs for control and flexibility.

In this report, we explore new research on the disconnect between finance leaders’ and employees’ perceptions of expense policies and explain what that divide means for cost control measures.

“Finance leaders are under pressure to keep expense budgets as lean as possible, but they also need to give employees a certain level of autonomy to make essential business purchases. They need to find that crucial balance between access and control. If they don’t, the conflict between these two perspectives will only continue to escalate, prompting even more out-of-policy spending.”

Kevin Permenter

Senior Director, Enterprise Applications

IDC

It all starts with corporate card access

The heart of the conflict itself is fairly simple. The majority of employees want corporate cards so they can make business-critical purchases without impacting their personal cash flow. In their mission to rein in costs, most finance departments only issue corporate cards to employees they deem qualified. The widely unmet need for corporate cards is the first factor that indicates the fundamental disconnect between employees’ preferences and the policies in practice.

In surveys of employees and finance professionals conducted by YouGov in January 2024, Emburse found that a significant number of employees (29%) still pay for business expenses out-of-pocket and file for reimbursement because they don’t have access to a corporate card. But they’d rather not use their personal cards. Given the high cost of living, the majority (55%) of employees would opt to make business purchases with a corporate card.

How employees pay for business expenses

Of employees that use a personal debit/credit card:

- 29% don’t have the option for a company card

- 21% have the option

Of employees that use a company card:

- 19% have the option to use a personal card

- 14% are required to use a company card

How employees would prefer to make business purchases

- 45% of employees would prefer to use a personal debit/credit card

- 55% of employees would prefer to use a corporate credit/purchasing card

Meanwhile, finance departments only issue corporate cards to employees who meet certain qualifications: 21% of organizations distribute cards to only senior executives (VPs and above), 22% issue them to managers and above, and 20% give them to managers and above with a specific need. In total, 63% of companies issue cards to managers in at least some scenarios. Only 17% of organizations issue corporate cards to anyone who needs them regardless of seniority.

For some organizations, selectively distributing corporate cards may work to control costs. But from the employee’s perspective, this policy can impede their ability to do their jobs effectively. If an employee needs to buy a critical piece of software, they must decide whether to front a potentially expensive subscription themselves, or wait for manager approval and payment and potentially delay their work. Many employees have a list of purchases vital to their daily work, from software subscriptions to remote office supplies to digital ads. As we’ll see in the coming chapters, when employees don’t have a streamlined way to pay for these expenses, spend chaos ensues.

Types of employees issued corporate cards

- 21% senior executives (VPs and above)

- 22% managers and above

- 20% managers and above with a specific need

- 17% anybody who needs them regardless of job level

RTO expenses and hybrid work add to the confusion

Many companies transitioning to hybrid environments have inadvertently created a gray area

regarding reimbursable expenses. For example, some organizations may choose to reimburse travel and accommodation expenses for employees who have moved outside of commuting distance to the office, and others may not. With changes in state laws adding to the complexity, finance leaders need to adapt legacy policies to the new normal. While many employers

have remote work expense policies in place (and some states, like California, have ruled in favor of employees seeking reimbursement for WFH expenses incurred during the pandemic shutdown), the same coverage doesn’t apply for RTO expenses.

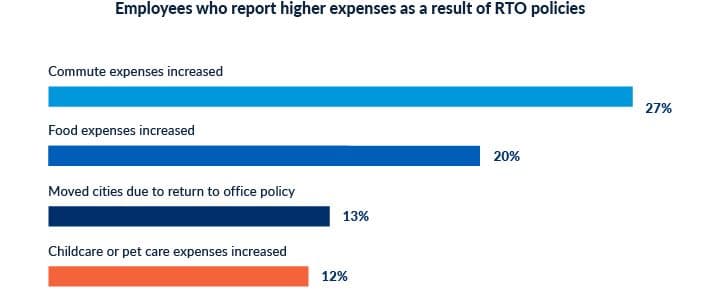

Unfortunately, returning to the office has placed additional strain on employees’ wallets. 27% of employees report experiencing higher commute expenses; 20%, food expenses; 12%, childcare or pet care expenses; and 13% have had to move cities to comply with their company’s RTO mandates.

Beyond impacting employees’ personal finances, maintaining a hybrid work setup creates a whole host of spend control issues. Distributed workforces can produce a high volume of recurring, decentralized expenses. In a distributed workforce, it’s common for employees to manage vendor payments with corporate cards or even their own personal cards. When employees buy goods and services (especially recurring services, like SaaS subscriptions) from vendors directly, they tend to submit them as expenses—a subsequent nightmare for the finance department, who only becomes aware of these vendor payments when processing a batch of regular expense reports.

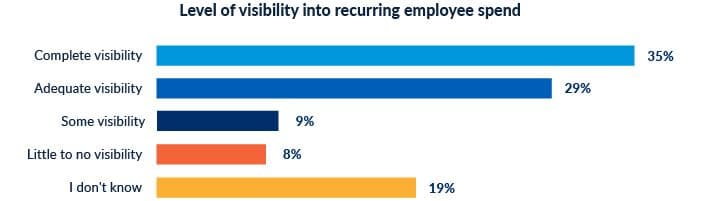

As a result, finance departments struggle to track these recurring vendor expenses, categorize them correctly, and reconcile them with the appropriate budget allocations in a timely manner. Additionally, employees may make purchases without following standard vendor approval processes, leading to duplicate or out-of-policy spending that takes additional time and energy to reconcile. While 63% of finance professionals believe they have complete or adequate visibility into recurring employee spend, the majority still manually track and process vendor purchases.

Expense policies are driving employees to fraud

All the aforementioned struggles have led some employees to a tipping point. They’re growing increasingly concerned over the state of their personal finances. Denying employees corporate cards and expecting them to front corporate expenses is essentially asking them for an interest-free loan. Employees are paying the price of expense policies by incurring debt and financial stress on their employer’s behalf, especially when they lack the funds to pay a card bill in full before an expense reimbursement arrives.

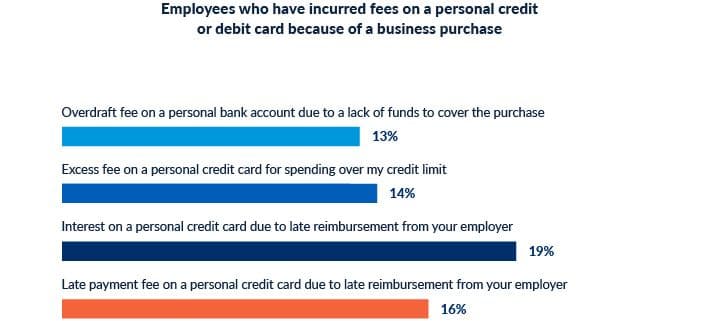

40% of employees reported incurring overdraft, excess, late payment fees or interest on a personal credit or debit card because of a business purchase. Additionally, 40% have been financially affected by their employer’s reimbursement times, either having to keep a closer eye on their finances or delay payments because they’re waiting for reimbursement.

On top of dealing with corporate expense policies that cost them money and cause stress about their own finances, the average employee is already struggling financially. 62% of employees are concerned about their personal finances, with 22% expressing that they’re “very concerned.”

The icing on the cake? Many finance professionals are unaware of how their expense management processes have put employees in uncomfortable financial circumstances, as suggested by the 50% of finance professionals who ranked their employees’ expense experience at an 8 out of 10 or higher.

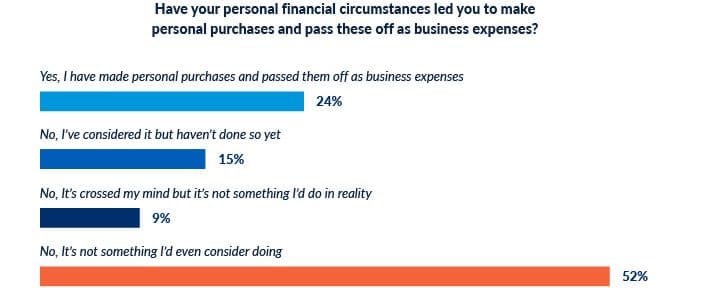

Corporate expense policies are compounding employees’ personal financial stress with undue pressure. As a result of their financial circumstances, 24% of employees admit to passing off personal purchases as business expenses. Another 15% have considered falsifying their expense reports but haven’t done so yet.

In light of this, is it surprising such a significant number of employees are committing fraud because of their personal finance circumstances? Not when you consider how severely they’re getting shortchanged by corporate expense policies, or when you consider the timing of this phenomenon. Fraud rates tend to increase during economic recessions when the cost of living is exceptionally high. In a 2009 study by the Association of Certified Fraud Examiners, 55% of respondents said that fraud had increased at their organizations since the beginning of the economic crisis. 48% saw an increase in employee embezzlement.

Emburse research on corporate expense fraud conducted in 2016 and 2019 found rates of fraud

hovering consistently around 5% every year. This 2024 survey marks the first time we’ve asked employees to self-report their fraud incidents since our 2019 report—since Covid-19, the enduring economic downturn, and the transition to hybrid and remote work.

If cost of living does play a factor in why employees engage in fraud, it would help explain why rates have jumped from 5% to 24% in just a few years. Taken together—the percentage of employees incurring fees because of business purchases made on their personal cards, financially affected by their employer’s reimbursement timelines, or admitting to fraud—the user experience under corporate expense policies dramatically underscores the need for a new approach to spend control. Otherwise, employees and finance leaders will stick to their Spendageddon collision course.

How to avert Spendageddon

It’s clear that meeting employee needs for convenience and autonomy is no longer a nice-to-have. Finance departments must implement expense systems that reduce the burden on employees. Now they know the potential consequences of creating corporate T&E practices that fail to center the end user: a poor user experience can drive employees to commit fraud. If that’s not the wakeup call finance needs to rethink their expense management practice, what else will it take?

When the user experience suffers this dramatically, so does your bottom line. Inappropriate and outdated expense policies, tools, and processes threaten both the employee’s and the company’s financial wellbeing. But modern expense management practices can bridge the gap between finance’s need for control and employees’ demand for autonomy. By creating rules that prevent out-of-policy expenses and overspend, finance departments can maintain oversight without stifling the user experience.

Some companies are afraid that equipping more employees with corporate cards will lead to more overall company spend. However, if your company embraces technology that automates policy enforcement, expanding the corporate card user base can actually help finance leaders more closely track, control, and even decrease spending.

Finally, the decentralization of employee purchases, especially for digital ad campaigns, SaaS subscriptions, and work-from-home expenses, presents a major challenge when employees funnel these expenses through T&E channels. This leads to a misclassification that complicates budget control and financial visibility, making it difficult for CFOs to manage expenses effectively.

Companies need to consider how they can extend pre-approval processes beyond traditional AP mechanisms to cover all types of employee-initiated purchases. This may involve setting policies around acceptable vendors, spending limits, and necessary approvals before a purchase is made, ensuring that expenses align with company policies and budgets.

Here are four strategies for controlling expenses to keep costs down and profitability up—while meeting employee needs for usability and corporate card access.

Set up automated expense controls to reduce spend leakage

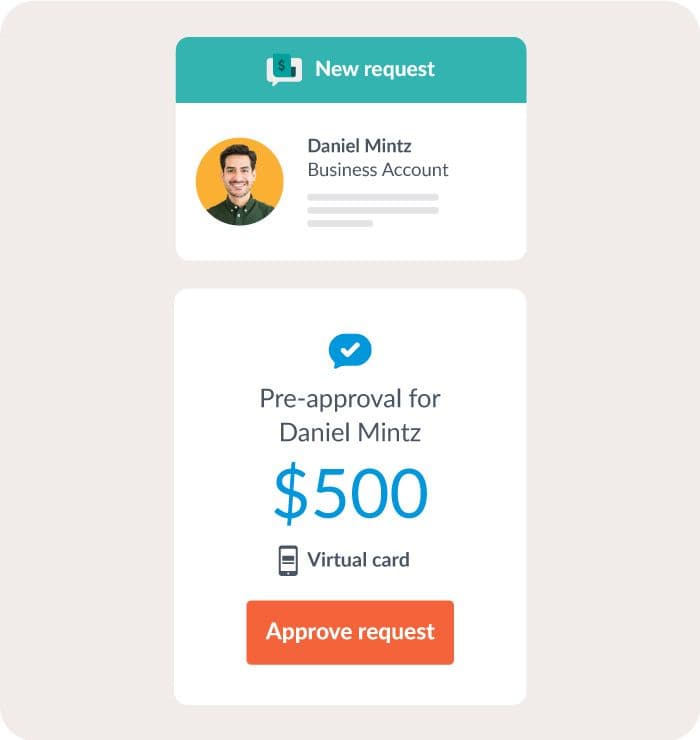

Policies only go so far in stopping unnecessary spending. Finance departments need controls at the pre-approval and procurement stage that automatically enforce policies and provide real-time visibility into where their capital is going. When employees make business-critical purchases, especially for software or subscriptions, it should be straightforward for the finance team to identify the vendor and specific purchases made. This clarity is crucial for managing software expenses, which can otherwise be obscured in general expense reports. One method for establishing stricter pre-approval processes for employee-driven spend is by issuing corporate cards with automated expense controls. Admins and managers can pre-set and customize compliance rules for cards to prevent out-of-policy expenses and overspend at the point of purchase or, even more proactively, at the point of request. These cards can auto-approve appropriate expenses, add contextual review to others, warn users of policy requirements, or block users from completing out-of-policy transactions.

Planning and tracking spend

Anticipating future spend is a key piece of managing cash flow. Companies should ensure that the budgeting process incorporates comprehensive data on vendor spend, including those processed through T&E. This integration helps in creating more accurate and realistic budgets, accounting for all expected and recurring vendor expenses.

Real-time dashboards on vendor spend through the T&E process can improve decision-making, spot trends, and reveal opportunities for consolidation and negotiation. With transaction data from pre-approved purchases, CFOs can access analytics that offer insights into spending patterns, vendor relationships, and budget compliance. This insight allows finance teams to identify all active vendors and anticipate renewals, preventing gaps in the budget.

Transition vendor payments to virtual corporate cards

Expanding the corporate card program by equipping employees with preloaded virtual corporate cards also helps to reduce fraud and gives financial leaders more sophisticated controls over employee expenses. Virtual cards facilitate employee spending—they can be created in minutes in lieu of a few days, and the funds are instantly available.

Virtual cards, like any modern corporate card, enable organizations to set purchase limits and policy controls up-front to get ahead of spending before it happens, instead of reconciling it afterward. Since virtual cards can be issued instantly, finance departments can easily create one for each vendor, making it simple to track and reconcile payments. By tagging these cards with pre-approval details, transactions automatically integrate into the general ledger, simplifying

expense recording and eliminating the need for manual entry. Adopting virtual cards can help companies equip more employees with corporate cards without the increased risk of overspend or fraud.

Proactively audit and detect fraud

Even with all these measures in place, some policy violations will still occur—whether through mishap or misdeed—making a streamlined fraud detection process essential. AI is adept at automating routine and rule-based tasks in auditing, including enforcing expense policies.

Accounting departments should leverage AI to detect suspicious activity before payment occurs and create alerts around unusual or high-dollar expenses. AI tools analyze transactions against pre-defined criteria to assess the probability of policy compliance, and route items with high probability of fraud or error to human auditors. This way, companies can protect their bottom line with less effort.

Conclusion

Finance leaders must understand employee’s user experiences and financial situations, and work with them to redefine T&E management practices. They need to consider how they’ll transition towards a proactive approach to T&E management, one that balances the need for cost control with the practical realities of employees’ spending needs. The road away from Spendageddon is paved with mutual understanding, technology adoption, and policy adaptation.

See how your expense practices affect cash flow

With insights from helping over 20,000 companies simplify expense management, T&E, and accounts payable processes, we've identified the key factors that might be holding you back from major savings. Use our five-minute spend ROI calculator to see how your monthly software costs, expense report quantities, and check volume contribute to the company's margins.

Learn how to better control your bottom line

What tangible steps should finance leaders take to optimize expenses and empower employees to make responsible spending decisions? Watch our 45-minute on-demand webinar and learn how to control employee spend before it happens and uncover savings across the business.

About Emburse

Emburse delivers innovative end-to-end travel and expense management solutions that solve for what’s next in forward-thinking organizations. Our suite of award-winning products is trusted by more than 12 million finance and travel leaders, and corporate travelers around the world. More than 20,000 organizations in 120 countries, from Global 2000 corporations and small-medium businesses to public sector agencies and nonprofits, count on us to manage business travel and employee expenses with ease.

Our highly automated, mobile-first solutions streamline business travel planning, booking and management, and eliminate manual, time-consuming expense submissions, approval, and reconciliation. We deliver efficiency and time savings, increase financial visibility, enhance spend control and compliance, and improve the entire business travel experience. This empowers our customers and their teams to deliver meaningful value for their organizations.

For more information visit emburse.com, or follow our social channels at @emburse.

Methodology

All figures, unless otherwise stated, are from YouGov Plc. Both surveys were carried out online. The total “Employee survey” sample size was 1,021 US adults who are businessmen/women. Fieldwork was undertaken between January 5–11, 2024. The total “Finance survey” sample size was 1,002 US finance professionals. Fieldwork was undertaken between January 16–21, 2024.