- products

- emburse cards

- why cards

Control over your corporate account

Control over your corporate account

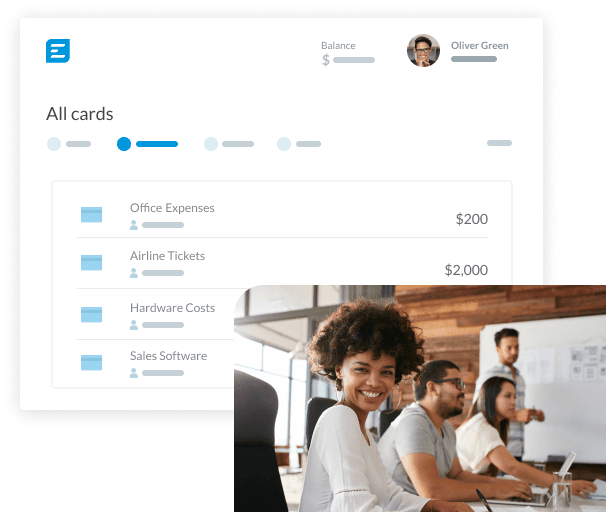

Issue physical and virtual credit cards with built-in rules to control employee spending.

What are employee credit cards?

These company-issued physical and virtual cards allow employees to make purchases on a corporate account, rather than using their own. Emburse Cards eliminate the need for reimbursement and minimize confusion over corporate expense policies.

Features that make a difference

Emburse Cards deliver on the promise to simplify and streamline employee spending and reimbursements, thanks to user-friendly features that include:

Virtual and physical cards

Order physical cards or create virtual cards which can immediately be used for online purchases.

Card assignments

Assign cards using just a name and an email address.

Enforce expense policies

Enforce granular spending restrictions on each card for specific vendors, events, or employees.

Shared cards

Securely share a card with multiple people to enforce group budgets.

Require receipts

Enforce expense policies by requiring receipts after every purchase.

Review transactions in real-time

Review transactions in real-time and filter purchases by date, category, or card.

Simplify bookkeeping

Export expenses to QuickBooks and download bank statements as CSV, OFX, or PDF files.

Preapprovals

Employee running low on their limit? They can instantly submit requests for additional funds to their manager.

Unique card numbers for each employee

Emburse lets you issue a unique credit card to each of your employees, instead of requiring them to share a corporate card amongst departments or offices. Each card can have individual limitations imposed on it, making it simple to implement a custom expense policy at every layer of your organization.

Take control of your corporate spending

If Emburse Cards sound like the right solution for your company, schedule a demo with our team to learn more.

Recognized by