With the rise of remote work and rapid technology change, what, where, and how employees spend is evolving. However, finance teams are stuck managing manual, time-consuming, and error-prone processes that haven’t adapted to the change in spending behaviors. With a lack of spend control and visibility, organizations grapple with policy violations and overspending.

Implementing an automated expense management solution [link to another blog or webpage that focuses on the basics of this] is a significant step towards getting expenses under control. It also opens the door to deploying additional tools and strategies for tightening spending. In this post, we will explore how you can take expense automation a step further with a feature in Emburse Certify Expense that actively protects against overspending: user allowances.

What are user allowances?

User allowances in Certify are specific monetary limits assigned to users for one or more expense categories over a designated period. Creating allowances helps prevent excessive spending from being processed and gives submitters and approvers visibility into their remaining available balance. Examples include:

- An annual allowance for professional development courses and conferences

- A quarterly allowance for remote employees to spend on home office supplies

- A monthly allowance toward personal utilities for business purposes, such as internet or phone bills

- A one-time allowance for business travel expenditures

Level up spend control

Without proper controls in place, overspending becomes rampant, budget adherence is compromised, and compliance risks loom large. User allowances offer a targeted solution to these pain points by empowering finance teams to set spending limits for employees across specific expense categories. Organizations that implement user allowances can reap many benefits.

- Budget Adherence: User allowances enable finance teams to enforce budgetary constraints within their expense management system, eliminating overspending and building fiscal discipline.

- Policy Compliance: By aligning spend limits with organizational policies, user allowances mitigate the risk of non-compliance and unauthorized expenses.

- Real-time Tracking: An automated expense management solution facilitates real-time monitoring of user allowances, providing instant visibility into how spend is tracking against budget.

- Employee Empowerment: User allowances empower employees to make informed spending decisions within predefined parameters, fostering accountability and ownership.

- Scalability: As organizations grow, finance teams can efficiently configure and maintain oversight of user allowances at scale to accommodate evolving spend practices and polices.

Let’s take a look at how it works.

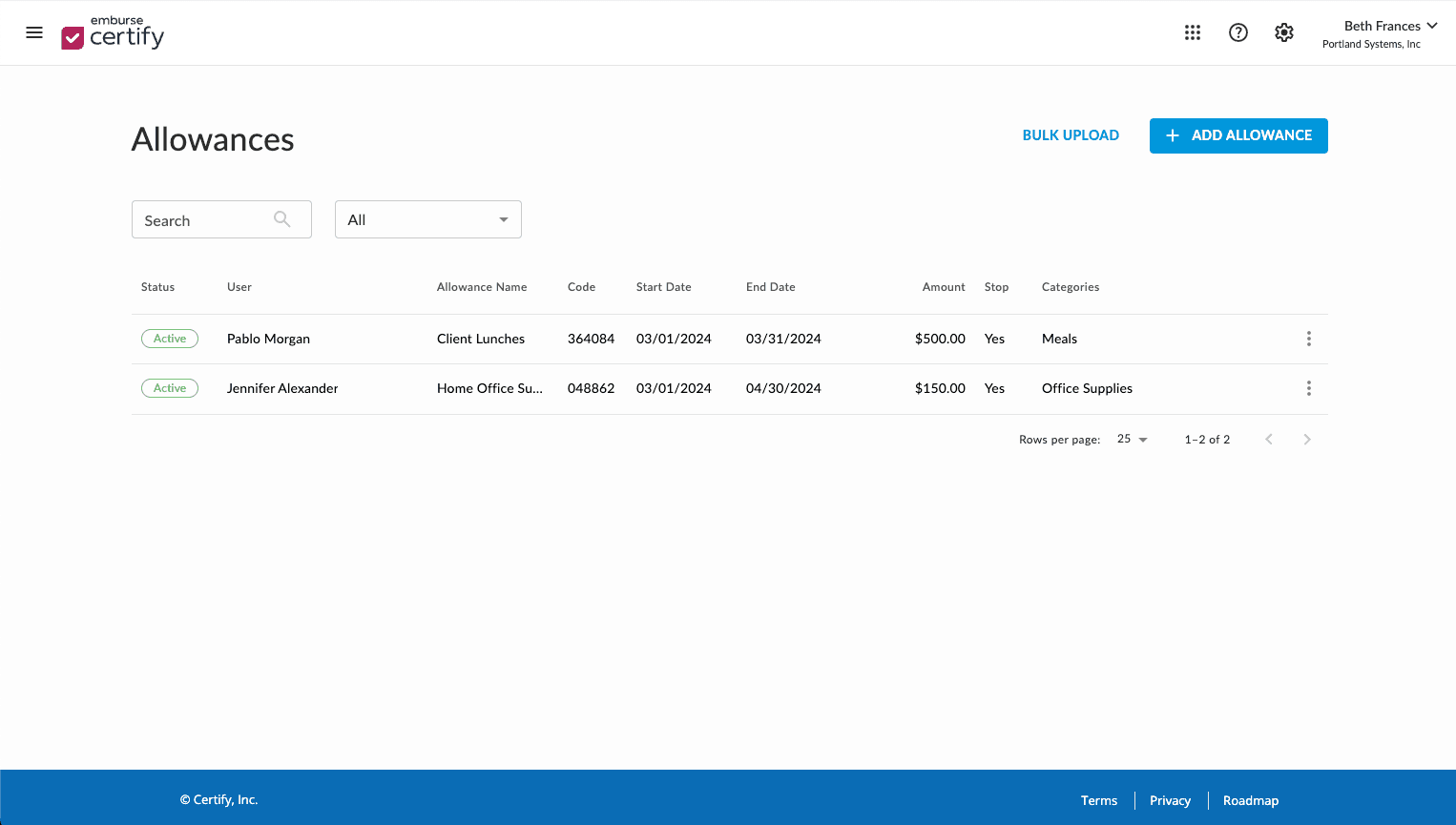

Certify administrators can configure user allowances to align with their organization’s policies and budgets. These settings dictate which expense items count towards the user allowance and how exceeding the allowance gets handled.

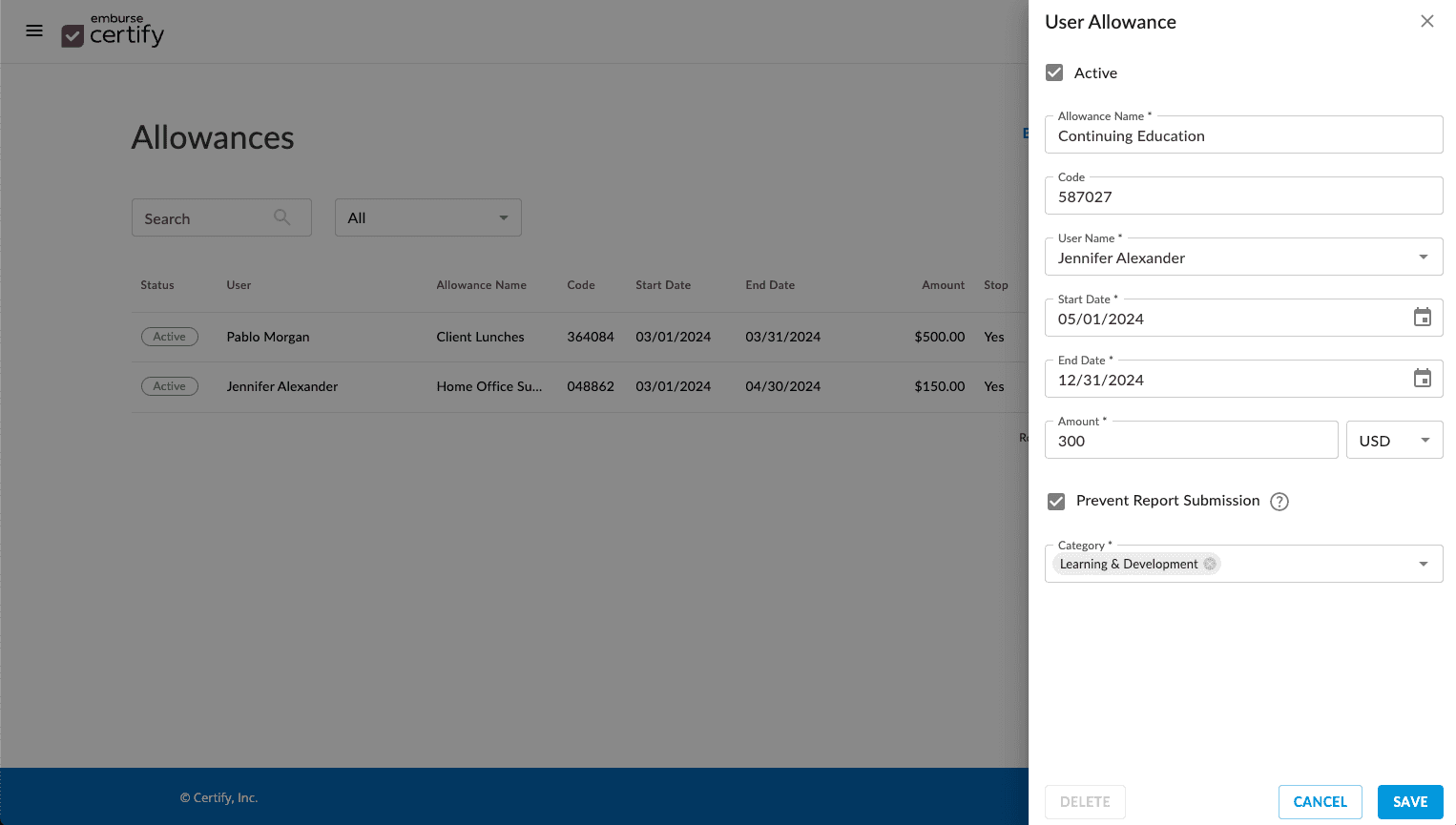

- Date Range: Customize the start and end date to correspond with the duration of a certain event or trip or with a budget period. If an expense item’s date falls within the specified date range and category, it counts towards that allowance. Best practice tip: keep allowances active even after the end date in the event that a user attempts to submit an old expense!

- Amount: Enter the amount a user can spend within the established time frame and expense category.

- Expense Category: Select one or more categories to be included in the allowance, such as continuing education, travel, home office supplies, meals, etc. When these categories are coded to an expense item, that expense amount will be counted towards a user’s allotted total amount they can submit.

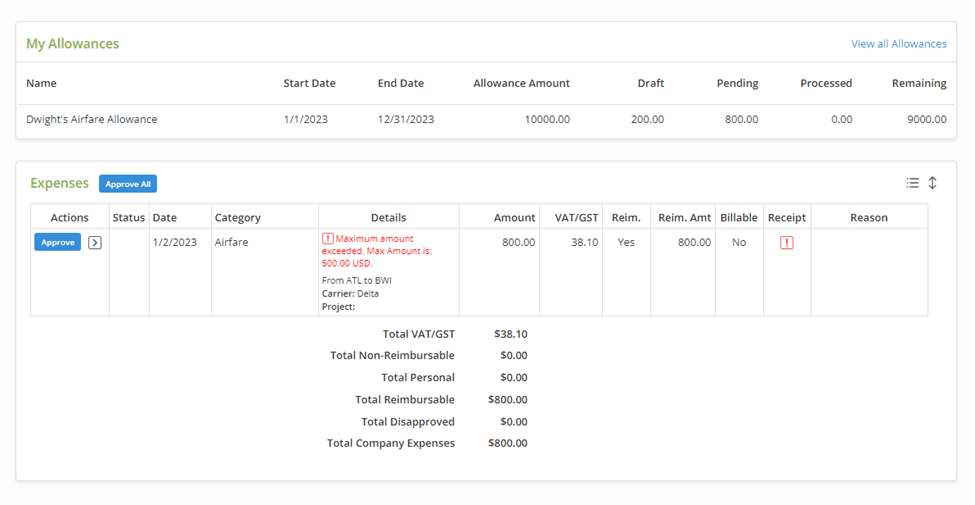

- Prevent Report Submission: Choose the level of enforcement you would like to accompany user allowances. Electing to prevent report submission stops users from submitting expenses exceeding the allowance limit. Opting out of this setting will enable expenses that exceed the allowance to be still submitted, but include a policy violation flag noting that the maximum amount has been exceeded.

A bulk upload option is also available to enable admins to create the same allowance for multiple users.

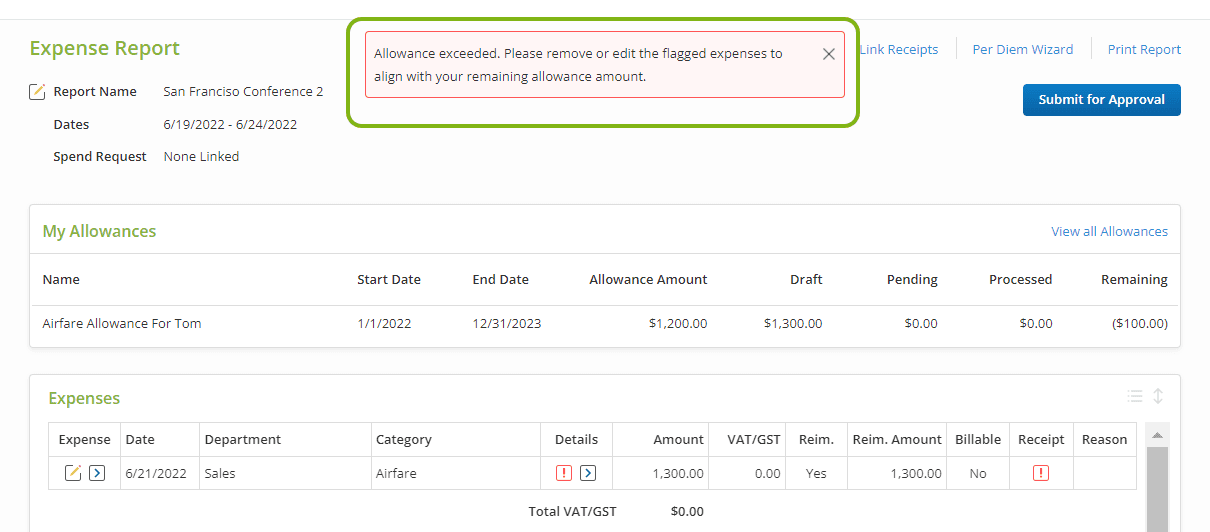

Once a user allowance is created, assigned users will see that allowance on any Draft or Pending expense report containing applicable expenses. The allowance tracker gives users a real-time look at their remaining budget, prompting them to exercise prudence in their spending decisions and mindfully plan their future spending.

Approvers see the same allowance tracker as submitters when approving expenses tied to an allowance, enabling them to make more informed approval decisions and stay abreast of how users are tracking toward their budgets.

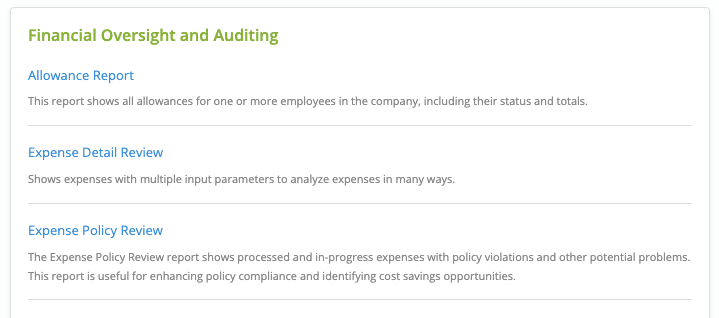

For additional spend visibility, accountants in Certify have access to the Allowance Report. This report provides an organization-wide view of all allowances, with insight into each allowance’s status to quickly assess their progress and identify any overbudget. Plus, individual users have access to a personalized version of this report called My Allowances, enabling them to monitor their assigned allowances.

In summary

User allowances provide the framework to instill spending discipline, ensure compliance, and pave the way for sustainable growth and profitability. By establishing predefined, auto-enforced spending limits that can be easily tracked, finance teams can proactively prevent overspending, identify trends, and optimize resource allocation. Significantly, it also cultivates employee accountability, giving employees the visibility and ownership they need to ensure they stay within budget and can get fully reimbursed for expenses paid out-of-pocket.

See it in action

Discover how an automated expense management solution with user allowances can revolutionize how you control spending. Request a demo today!